This is certainly not the type of post you would expect to come to our site to read normally, but due to Covid19 we wanted to make this blog post more personal and hopefully help some of our followers out. Below we will explain in a very brief and cut back way how we divide up our finances, which allows us to be able to renovate and purchase all our "needs" and the odd "want" for our home renovations. With the possibility of extra time on your hands during this unusual time you might find you have time to revamp your finances and find our spreadsheets helpful.

Essentially we have multiple bank accounts and split up our income across all our expenses as it comes in. The thought of multiple bank accounts in your internet banking may seem scary at first, but its' honestly the easiest way to keep your finances in order. Many accounts these days have no Fees if you chose to not receive paper statements so splitting up your money wont cost you any extra. Our multiple accounts are each labelled ie Insurance & Rates, and we have automatic payments set up which split up our Income every payday so proportions go into each account. This means when our Bills/Invoices come in the money is in our bank account ready to pay the bill. In a nutshell we have averaged out our expected Bills/Invoices for the year and part of our Income each time we are paid goes towards them.

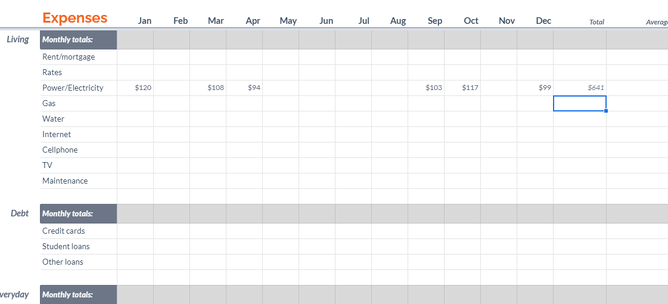

Step 1: Finding the costs of your expenses

The most daunting task is working out your Living Expenses. Keep it simple to start with, using our chart look up the basic ones we have set out. Internet banking is your best friend when filling this out, by using the search bar you can easily find several months up to a years worth of transactions rather than digging through all your paper Invoices. If you receive your Bills/Invoices by email, again this will be easy. You don't need to find every months, just as many as you can.

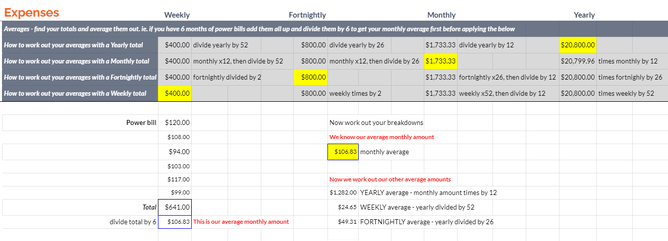

Step 2: Finding the average

Next find the average. Using all the figures you could find work out your average amount whether it be fortnightly, weekly, monthly or yearly. If you have all your power bills for the year you need to total them, then divide by 12 to get your average monthly amount. In our example we've only used 6 months worth of power bills.

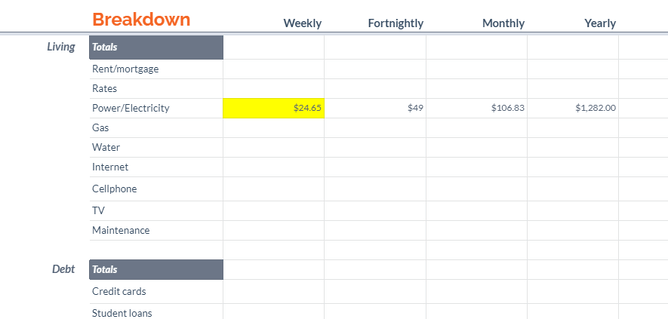

Step 3: Allocating your pay

You don't have to work out all the breakdowns. Just work out what suits your pay period if easier. So if you get paid weekly work out all the weekly breakdowns. If you get paid monthly only work out the monthly amounts. The aim of this is to work out how much from EACH PAY PERIOD you allocate to each expense. So in this example case if you get paid weekly you would put $24.65 each pay into an allocated account for power.

Step 4: The balancing act

When you initially start this it can be tricky until you have your reserves built up. The most important thing to remember is that this IS NOT a budget, it's accounting for the way you are currently living. Once your money is allocated it's much easier to see what you have left to work with and really helps with saving.

With this in mind you can now do one of two things -

- Include a savings amount. Say you want to purchase 3x 50cm Minimalist Shelf Ledges for your Kitchen renovation at a total cost of $ 144 ($138 + $6 shipping), and your target is to have them in 6months time. You would create a new line in your spreadsheet to allow for this and put aside an amount ($24 per month) of money every pay until said date. Or,

- Save a portion of the pay you have left after your allocations go out and put them in an account for your renovation (project or products you are wanting to buy). This works particularly well for people who's pay varies weekly for instant. A few hours extra worked can quickly add up if you put it aside. eg. $20 per week adds up to $1040 per year, which could go towards your Bathroom renovation.

Tips

Spreading the costs evenly throughout the year is so helpful for seasonal costs. For instance come winter our power bills usually increase, but this way of allocating your money will mean you don't feel the hit from it.

The same goes for Christmas, or school Fees and start of year costs. If you factor these in and set aside some money from each pay you shouldn't find these months really tight any more.

We hope you've found these tips helpful and wish you all the best achieving your goals!